Investment Funds

Systematic. Adaptive. Transparent.

Forward Lucy is a new generation of investment funds built on a powerful systematic engine that blends real-time sentiment analysis, behavioural clustering, and dynamic factor selection. Our strategies are designed to adapt intelligently to changing market conditions—ensuring portfolios stay both resilient and forward-looking.

We believe in transparency, discipline, and alignment with our investors. That’s why we offer clear reporting, performance-based pricing, and a model-driven approach that eliminates emotion from decision-making.

Built with transparency. Engineered for performance. This is investing, the Forward Lucy way.

Why Forward Lucy

Markets have evolved—but too much of traditional asset management hasn't. Many investment strategies still rely on outdated classifications, discretionary guesswork, and opaque processes. We believed it was time for something different.

We built Forward Lucy to rethink how portfolios are constructed, managed, and priced—starting from first principles. In today’s world, where sentiment drives markets and information moves in real time, investment strategies need to be systematic, adaptive, and transparent.

Forward Lucy was created to turn complexity into clarity: using data to capture real-time market sentiment, grouping securities based on how they behave—not where they’re listed—and dynamically tilting portfolios toward what works in the current environment.

And because we believe in true alignment with our investors, Lucy comes with a variable pricing model: we only benefit when you do. If the strategy underperforms, our fees automatically adjust down. That’s how investment partnerships should work—on principle and performance.

Forward Lucy is more than a set of funds. It's a new way of thinking about investing.

The Best of Data Science

Forward Lucy is built on the belief that better decisions come from better data.

We combine machine learning, big data, and natural language processing to interpret how markets are actually behaving—and how investors are feeling. Our system turns global sentiment, price movements, and behavioural signals into investment decisions that are fully systematic and free from human bias.

No guesswork. No gut feeling. Just a transparent, data-driven process designed to adapt to markets in real time and invest with discipline—even when emotions run high.

A Fee Model That Puts Investors First

At Forward Lucy, we believe that fees should reflect performance. That’s why our pricing model is designed with a large variable element—to ensure we only benefit when our investors do.

Here’s how it works:

-

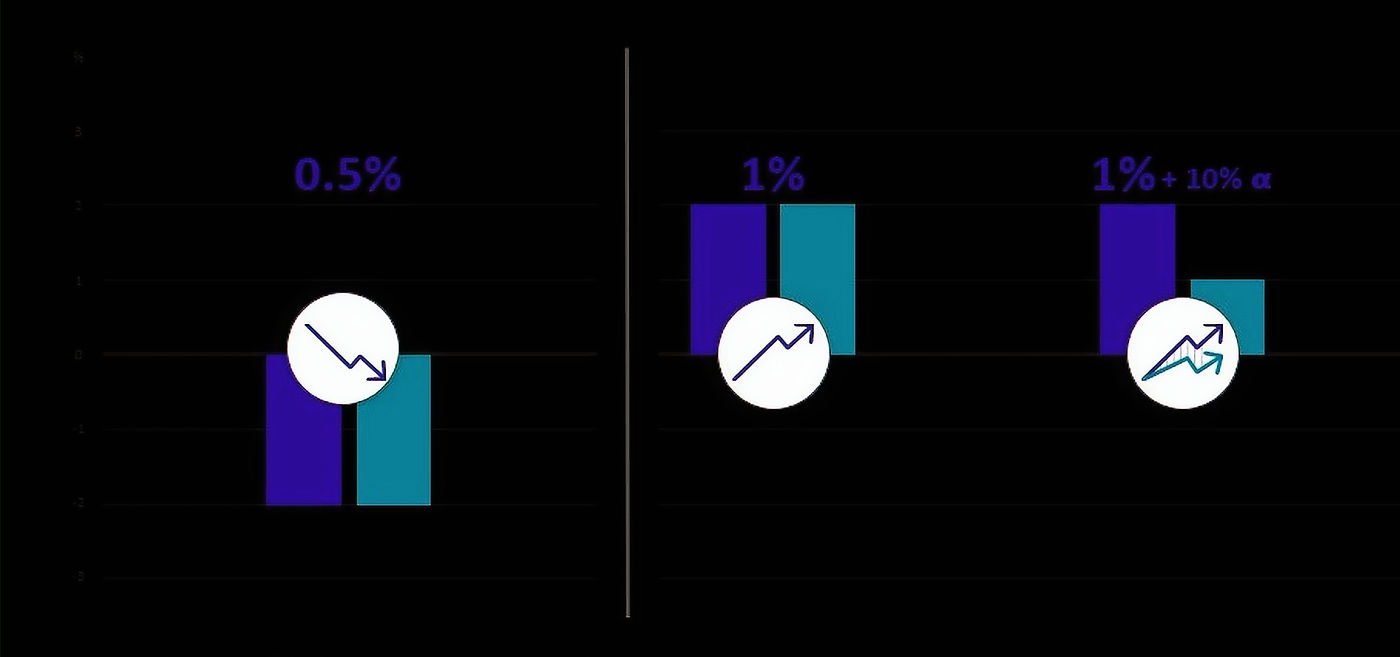

When returns are negative or below the benchmark, we only charge a reduced base fee of 0.5%.

-

If the strategy delivers a positive return, the fee increases to 1%.

-

If returns exceed the benchmark, we take 10% of the outperformance—but only on the excess.

This model ensures that Lucy’s incentives are fully aligned with yours:

We succeed when you do.

Base Fee

Absolute Fee

Relative Fee

If negative, this is all that Lucy takes

When performance is positive

When performance is positive & above benchmark

About Us

The Forward Lucy UCITS funds are managed by XX S.A., a Luxembourg-based investment management company regulated by the CSSF. We oversee the full portfolio management of the fund range and are responsible for its strategic development and ongoing oversight.

Our team brings together deep expertise in systematic investing, macroeconomic research, and data-driven portfolio construction, supported by strong operational infrastructure.